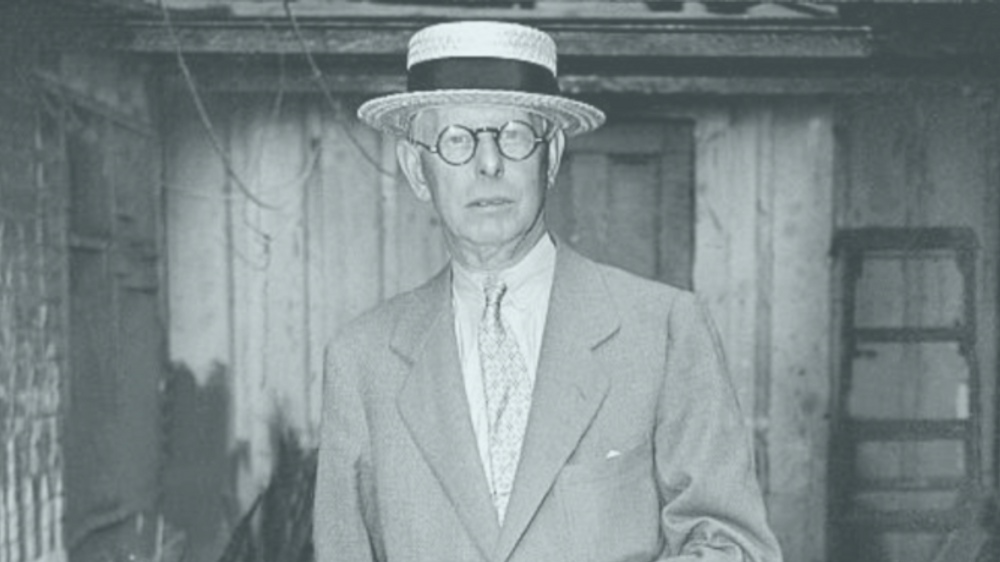

Jesse Livermore – Trader Wisdom Series

Jesse Livermore is arguably the most successful stock trader of all time, if not the most famous. Edwin Lefevre’s 1923 book, Reminiscences of a Stock Operator, was based on Livermore, and he also wrote his own book, How to Trade In Stocks, shortly before his death in 1940.

What can we learn from Jesse Livermore as traders in 2022?

Although he traded in the early 1900s, so much of Livermore’s wisdom is applicable to trading the markets today.

Here are our favourite Jess Livermore quotes:

1. “There is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.”

2. “Patterns repeat, because human nature hasn’t changed for thousand of years.”

3. “In any sector, trade the leading stock – the one showing the strongest trend.”

4. “Never average losses by, for example, buying more of a stock that has fallen.”

5. “The highest profits are made in trades that show a profit right from the start.”

6. “It is not good to be too curious about all the reasons behind price movements.”

7. “Never buy a stock because it has had a big decline from its previous high.”

8. “Never sell a stock because it seems high-priced.”

9. “There is only one side to the stock market; and it is not the bull side or the bear side, but the right side.”

10. “Wishful thinking must be banished.”

11. “Do not anticipate and move without market confirmation. Being a little late in your trade is your insurance that you are right or wrong.”

12. “Money in a broker’s account or in a bank account is not the same as if you feel it in your own fingers once in a while. Then it means something.”

13. “Only enter a trade after the action of the market confirms your opinion and then enter promptly.”

14. “For when I am wrong only one thing convinces me of it, and that is to lose money. And I am only right when I make money.”

15. “It is foolhardy to make a second trade, if your first trade shows you a loss. Never average losses. Let this thought be written indelibly upon your mind.”

16. “If you can’t sleep at night because of your stock market position, then you have gone too far. If this is the case, then sell your position down to the sleeping level.”

Jess Livermore on trading with the trend

17. “Buy rising stocks and sell falling stocks.”

18. “Big money is made in the stock market by being on the right side of the major moves. I don’t believe in swimming against the tide.”

19. “Go long when stocks reach a new high. Sell short when they reach a new low.”

Jesse Livermore on not overtrading

20. “Do not trade every day of every year.”

21. “There is a Wall Street fool, who thinks he must trade all the time.”

22. “Trade only when the market is clearly bullish or bearish.”

23. “It is much easier to watch a few than many.”

24. “There is time to go long, time to go short and time to go fishing.”

Jess Livermore and letting winners run and cutting losses

25. “Continue with trades that show you a profit, end trades that show a loss.”

26. “As long as a stock is acting right, and the market is right, do not be in a hurry to take profits.”

27. “Cut your losses quickly, without hesitation. Don’t waste time.”

28. “Profits always take care of themselves but losses never do."

29. “Don’t become an involuntary investor by holding onto stocks whose price has fallen."

Jesse Livermore on trading psychology

30. “The human side of every person is the greatest enemy of the average investor or speculator.”

31. “Successful trading is always an emotional battle for the speculator, not an intelligent battle.”

32. “Not taking the loss, that is what does damage to the pocketbook and to the soul.”

33. “A stock operator has to fight a lot of expensive enemies within himself.”

34. “I never lose my temper over the stock market. I never argue with the tape. Getting sore at the market doesn’t get you anywhere.”

35. “If you don’t know who you are, then the stock market is an expensive way to find out.”

36. “All through time, people have basically acted and reacted the same way in the market as a result of: greed, fear, ignorance, and hope.”

37. “No person can play the market all the time and win. There are times when you should be completely out of the market, for emotional as well as economic reasons.”

Jesse Livermore on trader patience

38. “Big movements take time to develop.”

39. “It never was my thinking that made the big money for me. It always was my sitting.”

40. “The market does not beat them. They beat themselves, because though they have brains they cannot sit tight.”

41. “Don’t take action with a trade until the market, itself, confirms your opinion. Being a little late in a trade is insurance that your opinion is correct. In other words, don’t be an impatient trader.”

42. “To anticipate the market is to gamble. To be patient and react only when the market gives the signal is to speculate.”

43. “No trading rules will deliver a profit 100 percent of the time.”

44. “It is literally true that millions come easier to a trader after he knows how to trade, than hundreds did in the days of his ignorance.”

45. “There is nothing like losing all you have in the world for teaching you what not to do.”

46. “The stock market is never obvious. It is designed to fool most of the people, most of the time.”

47. “The finest art is not to lose money. Making money in the stock market can be done by anybody.”

48. “He will risk half his fortune in the stock market with less reflection than he devotes to the selection of a medium-priced automobile.”

49. “A man must believe in himself... I don’t believe in tips.”

50. “Never buy at the bottom, and always sell too soon.”

51. “Markets are never wrong – opinions often are.”

This article is part of our Trader Wisdom series. If you want to read more, have a look at our pieces on ,W. D. Gann, ,Ray Dalio and ,Jim Simons.