How to Analyze and Day Trade Apple Stock Successfully

Apple is one of the most popular companies in the world, with its products being present in almost all countries.

It has also grown to become the biggest firm in the world with a market cap of over $2.16 trillion. The company has a healthy balance sheet, growing market share, and is a member of the FAANG group of companies.

This article will look at the best strategies for trading Apple shares.

Apple business segments

A key unique thing about Apple is the simplicity of its organization. Unlike other large companies like Microsoft. Alphabet, and Berkshire Hathaway, Apple does not acquire large companies. As a result, the company’s products and services are well-known.

Apple operates in four segments: iPhone, Mac, iPad, Wearables and accessories, and services. The iPhone is the main cash-maker for the company as it generated over $206 billion in revenue in 2022. It is followed by services, whose sales came in at $78 billion. Mac’s revenue came in at $40 billion while iPad and wearables came in at $29 billion and $41 billion.

Apple has increased its services offerings in the past few years now that they are pivotal to the company’s future. They include key services like Apple Music, Apple TV, Apple Care, Apple Pay, and iCloud among others.

Apple stock symbol, market cap, revenue and profits

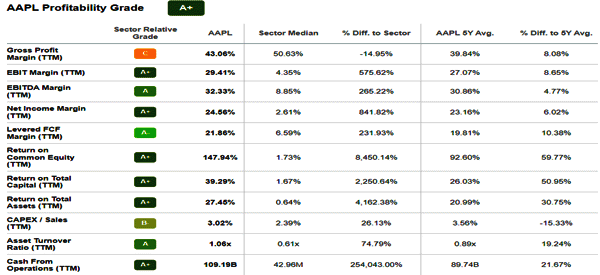

Apple’s ticker symbol is AAPL while its market cap is over $2.1 trillion. The market cap figure keeps changing because it depends on the share price. Apple is a highly profitable company, as you can see in the chart below.

Apple has continuously grown its revenue over the years. It made over $170 billion in 2013 and $394 billion in 2022. Its net profit jumped from $37 billion to $99 billion in the same period.

Apple market share

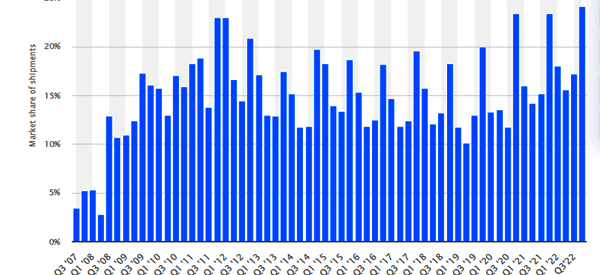

Apple has grown over the years because of the premium nature of its products and their strong market share. For example, the iPhone has a market share of about 24%, which is a big part because there are hundreds of companies in the industry.

Apple has a big market share in the computing industry even as it competes with the highly popular Microsoft-based products. The company sells hundreds of computers every year, making it a key player in the industry.

Further, Apple is the second-biggest music streaming service in the world after Spotify. It also runs the biggest grossing app store globally. While Android is the biggest Apple’s app store makes the most money.

Should you invest or trade Apple stock?

Therefore, a common question is whether Apple is a good investment or trading asset. We believe that there are merits for investing in Apple.

For one, as shown below, the company has been a strong performer in the past few decades. The shares have jumped by more than 45,000 since 2000. In its history, the shares have jumped higher than that.

Historical performance is not always an indicator of what to expect in the future. However, in some cases, it can act as a good indicator of what to expect. There are other reasons to invest in Apple. First, it has a simple-to-understand business model.

Second, the firm has a loyal following and aspirational products. Most people who buy smartphones aspire to buy the iPhone. Third, Apple is a highly profitable company that has continually grown its market share.

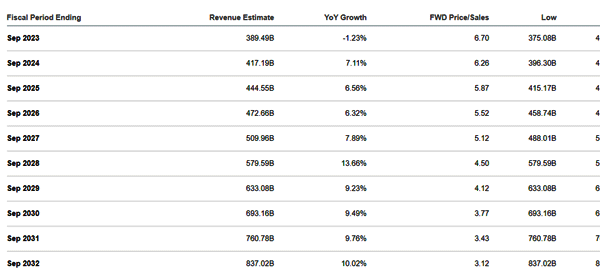

Most importantly, analysts believe that Apple’s business will keep growing over the years as shown below.

However, we also believe that you should day trade Apple shares as well for several reasons:

- Apple is a highly liquid stock - the company sees millions of shares change hands every day. As a result, this makes it easy to buy and sell the stock.

- Apple is a volatile stock - Further, Apple is a highly volatile stock, which creates interesting entry and exit points.

- Apple makes headlines - Further, Apple is widely covered by most people in the financial industry, which makes it easy to find opportunities.

- Offered by most brokers - Apple shares are offered by many online brokers, making it highly accessible.

Therefore, we recommend having Apple in a long-term investment account and also in your trading account.

Good reasons to avoid Apple

The biggest reason you may want to avoid Apple is that its stock seems a bit overvalued since the company has a price-to-earnings ratio of 27. Also, if you are in it for dividends, you should avoid Apple because of its tiny dividend yield of 0.55%.

How to analyze Apple stock

There are two main things to consider when analyzing Apple shares. As a long-term investment, you should look for more details about the company. Some of these things to consider are:

- Revenue and profitability growth - You should look at the overall revenue and profitability growth over the years. As mentioned above, these metrics have been improving over the years.

- Segment growth - You should look at the company’s segment growth, where you look at key parts of the business. The most important part of this business is its services segment.

- New product launch - You should focus on the company’s product launches and their profitability.

- Dividend growth - You should look at the company’s dividend growth, safety, yield, and consistency.

- Estimates - Finally, you should look at the company’s revenue and profitability estimates.

Second, as a day trader, you should always focus on technical analysis. This involves looking at the overall chart patterns and using technical indicators to predict where the shares will go next. As a day trader, you should use short-term charts.

Related » How to trade tech stocks

SWOT analysis for Apple stock

One of the best approaches to analyze stocks is to look at the SWOT analysis. Here are some of the top attributes of Apple stock in this regard.

- Strength - The key Apple strengths are its strong balance sheet, customer loyalty, growing market share, and global brand awareness.

- Weakness - Apple has little weakness other than its dependence on the iPhone, which brings in the most cash. Also, the company has a low dividend yield.

- Opportunity - Apple has the opportunity for growing its market share globally.

- Threats - Apple has several threats. First, it has a huge exposure to China. US and China tensions are growing. Second, the strong US dollar is making its products unaffordable in many countries. There are regulatory concerns, especially because of its app store. Finally, Apple TV+ is struggling to compete with the likes of Netflix.

Strategies to day trade Apple stock

There are several strategies to day trade Apple shares. First, the most common strategy is known as trend moving. This is a strategy that involves buying the shares when they are rising and holding the position until the trend fades.

Second, you can trade reversals. This is where you wait for a trend to fade and then trade the reversal. In most cases, this trading strategy works when traders use technical indicators like moving averages and the Relative Strength Index. It also works when people use chart patterns like double-top and head and shoulders.

Third, you can use candlestick patterns like doji, hammer, and shooting star to identify breakouts and reversals.

The other strategy is known as scalping, where you open positions and then exit shortly afterward with a small profit.

Summary

In this article, we have looked at Apple and some of the key things to consider when investing and trading it.

As we have seen, the company has a strong market share in key industries, is highly popular among traders and individuals, and has been a strong performer.

External useful resources

- How To Buy Apple (AAPL) Stocks & Shares - Forbes