Why Backtesting Your Trading Strategy is Critical!

A trading strategy is defined a systematic method of buying and selling financial assets based on specific rules that a trader has created.

For example, a trend-following trading strategy involves buying and selling when there is a pre-existing trend.

To have a successful career, however, it is not enough to just take a strategy and adopt it. We must also try it out and try it again to ensure it works. In this article, we will explain how you can backtest a trading strategy well.

What is backtesting?

Backtesting is a process where a trader takes a trading strategy and uses historical data to estimate the profitability of an approach.

It involves applying a strategy, either manual or automated one, to a real-world situation. The idea is that a trading strategy that did well in the past will produce a better result in the future.

It is always recommended to backtest a strategy before applying it to a live account. In most cases, this usually happens in a demo or practice account. A demo is a trading account that has real data and virtual cash.

It is worth noting that backtesting a strategy is not always a guarantee that it will produce solid results in the future. In some cases, a strategy can work well in a backtesting environment and then fail in a real-world environment.

In most cases, backtesting is associated with an automated trading system or a robot. A bot is a piece of software that does analysis and then then executes trades. It can also set a stop-loss and a take-profit to properly manage risks.

Most trading platforms like MetaTrader and TradingView have inbuilt tools to backtest automated bots. Their backtesting tools are so advanced that they can easily be manipulated to handle these tests in several ways.

Backtesting vs paper trading

Backtesting and paper trading are often used interchangeably. However, there is a difference between the two. As described above, backtesting is the approach where you have a trading strategy and test it using historical data.

Paper trading, commonly known as demo trading, is a process where you use a demo account to execute trades. It is mostly used to create a trading a strategy and to simulate how a trader would perform in a real account.

Related » How to Switch From Paper Trading to Live Trading

Why you need to backtest your strategy

Backtesting is an important thing that any trader should do. Several benefits of doing this are:

Simulate future performance - It makes possible to simulate future performance of a trading strategy. No risk of capital - Backtesting in a demo account makes it possible for a trader to experiment different scenarios without putting their capital at risk. Tweak a strategy - It gives a trader the opportunity to tweak a strategy without risking their capital. For example, a trader can test various periods of moving averages to identify the best-performing one.Types of backtesting

There are three main types of backtesting in day trading, including:

Replay - Replay is a type of backtesting that is offered by most trading platforms. It makes it possible for a trader to simulate a live market environment based on the past trading data. Coded - This is a backtesting strategy that is popular among algorithmic traders. In it, they run different types of simulations to determine the potential outlook of a trading strategy. Manual - This is the most popular backtesting approach. It involves coming up with a strategy and then simulating its performance manually. For example, you can decide to focus on a triangle pattern and go back to see how it has performed historically.How to backtest a strategy

A common question among many traders is on how to do a good backtesting strategy in trading. Here are some of the top steps to follow when you test the efficiency of a strategy:

Develop a trading strategy

This is the important stage where you come up with a strategy based on your preferences. Some of the top trading strategies you can use are: double moving average, Bollinger Bands, trend-following, reversal, and algorithmic. You can develop a manual or automated trading strategy.

Use a strategy tester

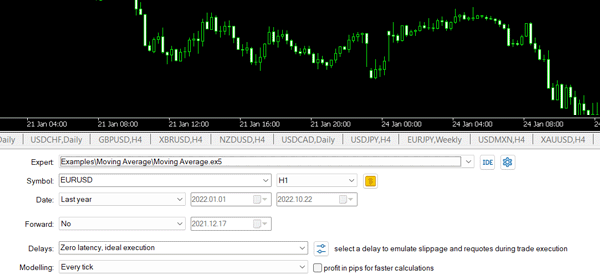

If you opt for an automated strategy, you now need to use a strategy tester, which is provided by your trading system. For example, the chart below shows the outcome of a strategy tester on the MT5 trading software.

In this chart, we are testing a moving average strategy on the EUR/USD pair.

In this chart, we can see several important data points that should be entered when backtesting a trading strategy, including:

Period - This refers to a period when you are backtesting the strategy. In most cases, the period should be relatively close. On period, you must choose the exact period based on your trading strategy. If you use the hourly chart, you should always backtest on the same chart. Delays - Delays refers to the period or latency of execution. Deposit- You can place an indefinite amount of money in a demo account. However, you should backtest using the exact amount that you are trading with.The chart below shows the results of a backtest. These results shows that the strategy had a net loss of $195.

Tweak the strategy

Finally, you should tweak the strategy and do a backtest again. For example, if you are using a 25-day moving average, you can change it to 20 and see the outcome of the backtest.

Strategies and rules to backtest

There are several unwritten rules for backtesting a trading strategy. Some of them are:

Don’t be in a hurry - You should always take your time to backtest a strategy. In most cases, you should take at least two weeks to do it. Use the same assets you trade - Always do backtesting on the same assets that you trade. If you trade the EUR/USD pair, then backtest on it. Period - As mentioned above, you should always focus on the period that you use to trade. If you use the hourly chart, always backtest on it. Add pricing - You should always add the pricing and all costs involved in executing trades.Pros of backtesting

Trading without risking capital. Automated strategy testing is fast and easy to use. It makes it possible to adjust a trading strategy.Cons of backtesting

This is not an accurate method of gauging the performance of an asset. Historical data is not always a good indicator of future performance. Market conditions tend to change on a regular basis. At times, there could be insufficient data to do this backtesting.FAQs

Why is backtesting important?

It is an important thing since it makes it possible to see the performance of a robot without risking your real capital.

Is backtesting necessary?

This approach is a necessary thing for any trader regardless of the strategy they are using. It can help them identify whether a trading strategy is effective or not.

How much backtesting is enough?

You should do enough tests until you are sure that a trading strategy is working. In most cases, you should attemp to test it in all market conditions.

What is the difference between backtesting and forward testing?

Backtesting is difference from forward testing. Back-testing uses historical data to gauge the performance of a strategy. Forward-testing, on the other hand, uses simulations for future data.

Summary

Whether you are just beginning your career as a trader or already have experience in the markets, you cannot overlook the practice of backtesting.

Testing new strategies or trying to improve your own over time is essential for any trader to best adapt to any situation in the market. Being able to do this without risking money- even with historical data -is a must.